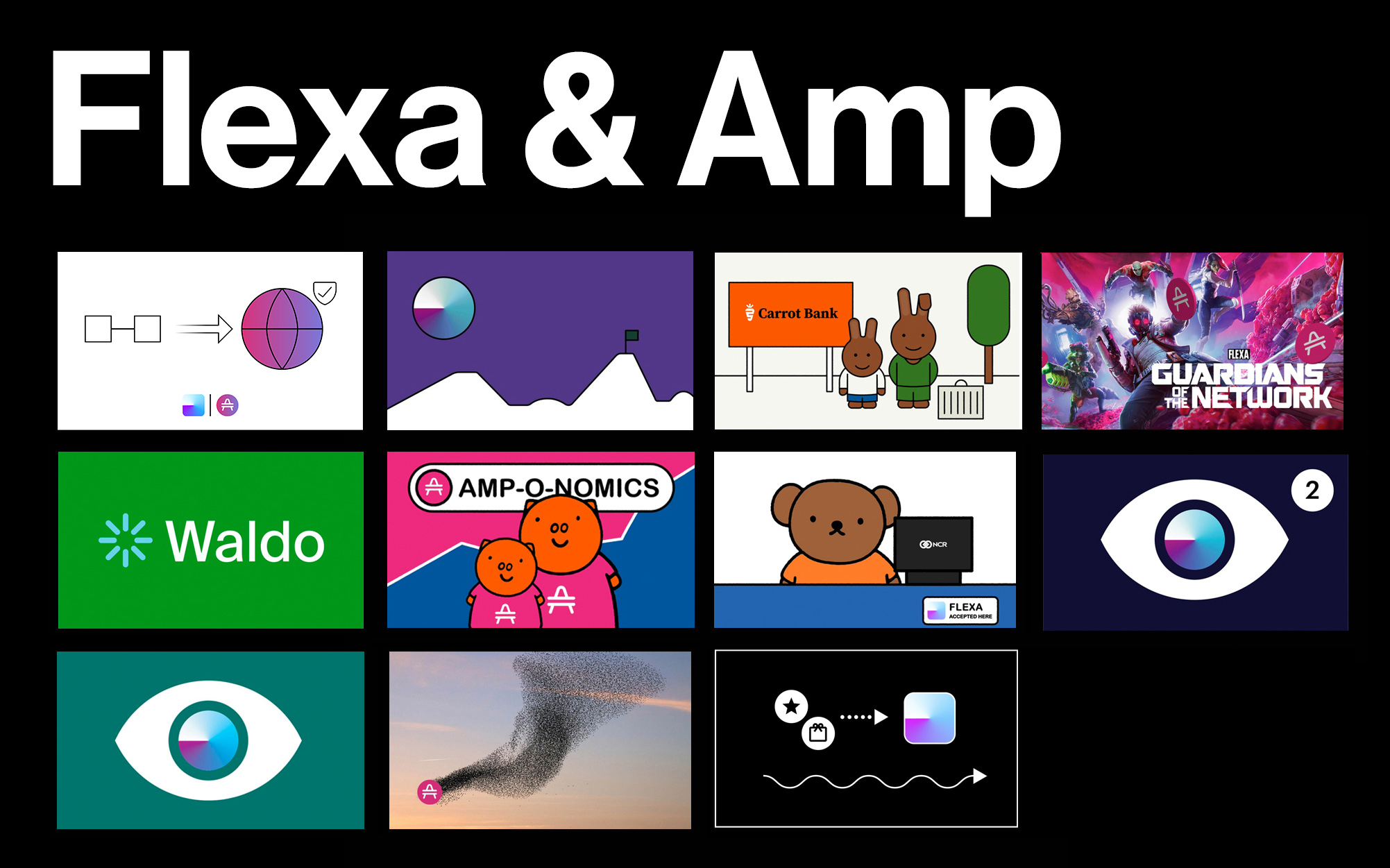

The Flexa network and Amp, its collateral token.

Why Invest in Flexa Network?

In September, Flexa announced the hiring of Michelle Ann Gitlitz as its General Counsel. The lawyer previously ran Washington D.C.-based international law firm Crowell & Moring’s Blockchain and Digital Assets practice. She also co-led their Financial Services practice. She brings more than 20 years of experience to the table.

Gitlitz stated in the company’s press release:

Flexa’s superior technology and zero-fraud guarantee should alleviate concerns that impede the broader institutionalization of digital currency as a medium of exchange. I welcome the opportunity to bring my experience in payments, virtual currency money transmission, and blockchain technology to bear as we get digital asset acceptance to merchants and consumers across the globe.

Companies hire people all the time. So you’re probably thinking: what’s the big deal?

The big deal is that a partner in a law firm decided to jump ship and leave the cozy confines of the legal world to help grow Flexa. The lawyer was once an analyst at UBS Warburg. She clearly understands the potential of Flexa’s business.

For me, businesses such as Flexa that provide the infrastructure to drive the digital asset and blockchain economies will do very well over the next decade. In many ways, we are at the beginning of Financial Services 2.0 or 3.0.

While it’s hard to tell who’ll ultimately be victorious, investors ought to be a lot more interested in Flexa than Shiba Inu, primarily because the former provides considerably more utility.

Bottom Line

How do you invest in Flexa?

In late 2021, it sold $6 million of Amp (CCC: AMP-USD), the collateral token of the Flexa network. In total, Flexa’s sold $20 million in AMP-USD to finance its growth strategies.

So, if you think Flexa is the bee’s knees, you could always buy some tokens.

As for investing in the company itself, you’ll have to wait until it goes public. When it does, I’ll be very interested in reading its prospectus.