Flexa offers the fastest network globally, with easy-to-use DeFi protocols that will become the new gatekeepers to crypto.

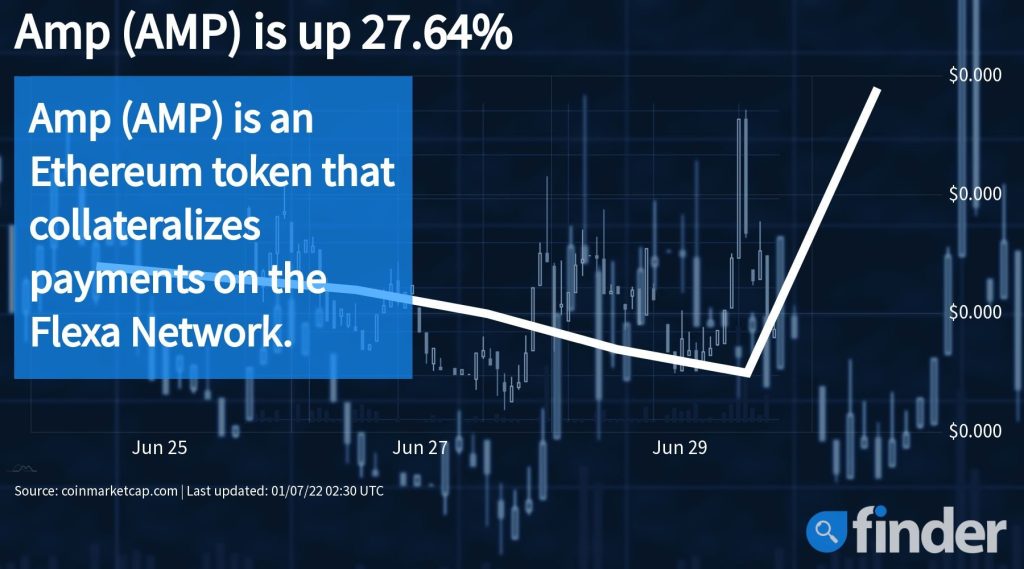

Amp is the new digital collateral token offering instant, verifiable assurances for any value transfer. Using Amp, networks like Flexa can quickly and irreversibly secure transactions for various asset-related use cases.

Created by the Flexa team, Amp is an open-source protocol based on Ethereum ( ETH 3.25% ). Flexa’s unique value proposition is derived from the digital payment platform’s merchant-focused design. Amp tokens power the Flexa network, which is increasingly being viewed as the future of how merchants may process transactions on the blockchain.

The Amp Token Makes Instant Payments Possible.

One of the significant drawbacks of cryptocurrency has been the lag time between when payments are sent and when transactions are processed. The time a block takes to be validated varies across various blockchain networks. Accordingly, high-volume users, or those requiring speedy payment, often need more recourse but to hurry up and wait.

Amp solves this by allocating its token as collateral. If a payment fails, the merchant will receive Amp and be compensated for the loss. It is a novel idea in the cryptocurrency space and should excite investors.

Security has also been a critical pain point for blockchain-based payment processors. Amp has been designed to be an open-source and extensible network, and future developers can add to the protocol to increase the number of use cases. More users also mean increased network security. Amp’s security has been validated by leading research firms such as ConsenSys, Diligence, and TrailOfBits. In this regard, the network earns top marks in my book.

Amp’s rigorous testing and track record of providing safe, lightning-fast transactions are encouraging. Indeed, Amp is an attractive option for investors looking to build a long-term position in an emerging cryptocurrency.

Who is the Team Behind Amp?

Flexa and Consensys developed AMP.

Flexa’s digital network eliminates chargebacks and unexpected reversals so that you can confidently take payments. We 100% guarantee all payments when they hit your POS.

Flexa connects directly to your existing payment infrastructure through various processors, middleware providers, and cloud POS. We also offer SDK and API options for custom integrations.

It is trusted at over 41,336 retail locations in the US and Canada.

How was Amp Launched?

Flexa’s private sale of its AMP token ended on Nov. 20. Newly disclosed players include Compound Finance founder Robert Leshner’s Robot Ventures II, Starwood Capital founder Barry Sternlicht, AlpInvest founder Volkert Doeksen, and Innopay founder Douwe Lycklama.

What is AMP staking?

Amp is an extensible platform for collateralizing asset transfers. By staking Amp, any value exchange can be guaranteed: digital payments, fiat currency exchange, loan distributions, property sales, and more.

How to stake AMP?

To stake AMP tokens, you need to follow these general steps:

- Choose a Staking Platform: Look for a reputable staking platform that supports AMP token staking. Ensure that the platform is secure, well-established, and provides a user-friendly interface.

- Create an Account: Sign up and create an account on the chosen staking platform. Follow the registration process and complete any necessary identity verification steps.

- Deposit AMP Tokens: Deposit your AMP tokens into the staking platform’s provided wallet. Typically, you would need to initiate a transfer of AMP tokens from your wallet to the staking platform’s wallet.

- Select the Staking Option: Choose the staking option available on the platform. There might be different staking durations or plans to choose from. Take note of the staking period and any associated fees or rewards.

- Confirm Staking Details: Review the staking details, including the number of AMP tokens staked, the duration, and applicable fees. Ensure that you are comfortable with the terms before proceeding.

- Initiate the Staking Process: Initiate the staking process by confirming your intention to stake your AMP tokens. Follow the platform’s instructions to complete the staking process. It may involve confirming the transaction and signing it using your wallet.

- Track and Monitor: After completing the staking process, you can monitor your staked AMP tokens. Keep an eye on the staking rewards, the staking period, and any changes in the staking platform’s policies.

- Unstaking and Withdrawal: If you decide to unstake your AMP tokens, follow the staking platform’s instructions to initiate the unstaking process. This process typically involves waiting for a specific unstaking period before withdrawing your tokens to your personal wallet.

It’s important to note that the specific steps and user interface may vary depending on the staking platform you choose. Make sure to read and understand the instructions provided by the platform before proceeding with staking your AMP tokens.

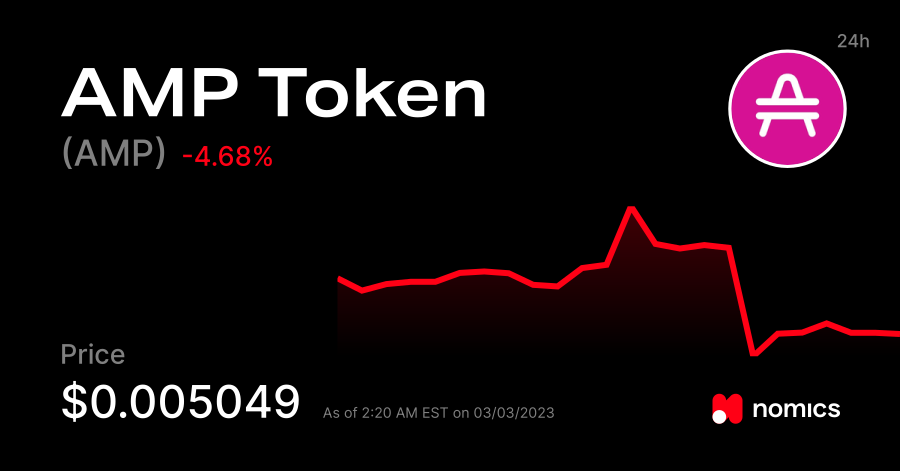

Is the AMP Coin a Good Investment?

Because of Amp’s growth, Flexa can now boast $1.4 billion in transactions processing at a time. With the amp token as collateral for any cryptocurrency transactions, there is a guarantee against fraud or defaulting on a contract.

Amp (AMP) is listed in the Crypto.com App and joins the growing list of 100+ supported cryptocurrencies and stablecoins, including Bitcoin (BTC), Ether (ETH), Polkadot (DOT), Chainlink (LINK), VeChain (VET), USD Coin (USDC), and Crypto.org Coin (CRO).

Amp (AMP) is a digital asset token built on Ethereum (ETH) under the ERC20 standard for tokens and is used to collateralize payments on the Flexa Network. It aims to enable immediate and irreversible settlement of more secure payment transactions.

Amp now supports various protocols and asset-related use cases with its design to decentralize risk in payment transactions and reduce assurance costs.

Crypto.com App users can now purchase AMP at actual cost with USD, EUR, GBP, and 20+ fiat currencies and spend it at over 60M merchants globally using the Crypto.com Visa Card.

Note:

– Amp is not available for residents of the United States.

Are There Any Risks to Staking AMP?

There is a risk associated with custodial lending, and please research accordingly.

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that AMPRaider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and AMPRaider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.