The crypto industry is filled with people who consistently Profit and those who always lose.

One deciding factor separating the winners from the losers is that they use the best crypto tools available.

While networking with other investors in the industry should be an ongoing task, some luck is involved with meeting the right people and finding out about top trading tools.

On the other hand, experimenting with different tools that fit your needs is something you can take action on now, and it will likely change how you operate for the better.

It can differ between discovering the next hidden gem that can double your portfolio or following the herd and buying overpriced cryptocurrencies.

In this guide, I’ll provide a checklist of the best crypto tools to use in 2023 that will completely transform how you interact with the crypto sphere.

Best Exchanges

Why Does it Matter to Choose the Best Exchanges?

The first step to profiting big is choosing reliable exchanges to trade with. They are your gate to the crypto world.

Three main factors differentiating between a helpful and useless exchange are liquidity, security, and fees. Look for them when you choose the best crypto exchange platform for you!

- Liquidity defines the ease at which an asset can be bought or sold. If there is a lot of liquidity, then there will always be a buyer or seller waiting on the other side of your order request.

- The second factor is security. When your money is on an exchange, you trust them to hold your funds, so you better hope their safety is up to par.

- Exchanges are constantly under attack. A recent example is Cryptopia which had hackers siphon millions from the exchange. Although these funds have now been reimbursed, imagine waking up one morning to all your funds being stolen from the exchange. Needs improvement!

- The third factor is fees. Top traders in the industry are aware of fees, including them in their profits. Because of this, I will recommend exchanges that aren’t only liquid, secure, and cheap.

The Best Exchanges:

Binance

At the time of this writing, Binance has the most volume in the market. It means they have the most transacted money and are the most liquid. They also have the most users and have never been hacked. With a clean track record, a reliable team, and lots of liquidity, I am confident in recommending Binance as one of the exchanges you must use.

Coinbase Pro

Coinbase Pro offers fewer trading pairs than Binance but is well-trusted, especially by more prominent investors. They are US-based, FDIC-insured, and have never been hacked. FDIC insured means that US users are insured for up to $250,000 (of their USD wallet) if something unfortunate happens.

BitMEX

Are you a risk taker? Then BitMEX is for you. They offer up to 100x leverage, which means high risk and reward. They are Hong Kong based and have also never been compromised by hackers. BitMEX is an excellent alternative to spot trading exchanges such as Binance and Coinbase Pro.

Best Decentralized Exchange

What is a Decentralized Exchange (DEX)?

A decentralized exchange serves the same function as a centralized exchange, like the ones mentioned above, but the technical infrastructure is decentralized.

Why use DEXs in addition (or instead) to Centralized Exchanges?

The advantage of decentralized exchanges is that the users do not need to deposit funds to the exchange, so they can keep their funds secure in their wallets.

Ultimately, users maintain greater security when using DEXs but they are often more challenging to use and have less liquidity.

What are the best DEXs?

INDEX

IDEX is one of the oldest decentralized exchanges that is still running today. They are web-based and have a sleek user interface. They also have enough liquidity that the average trader will have no issues filling orders.

Trading Platforms

What is a Trading Platform, and How will it Help Me?

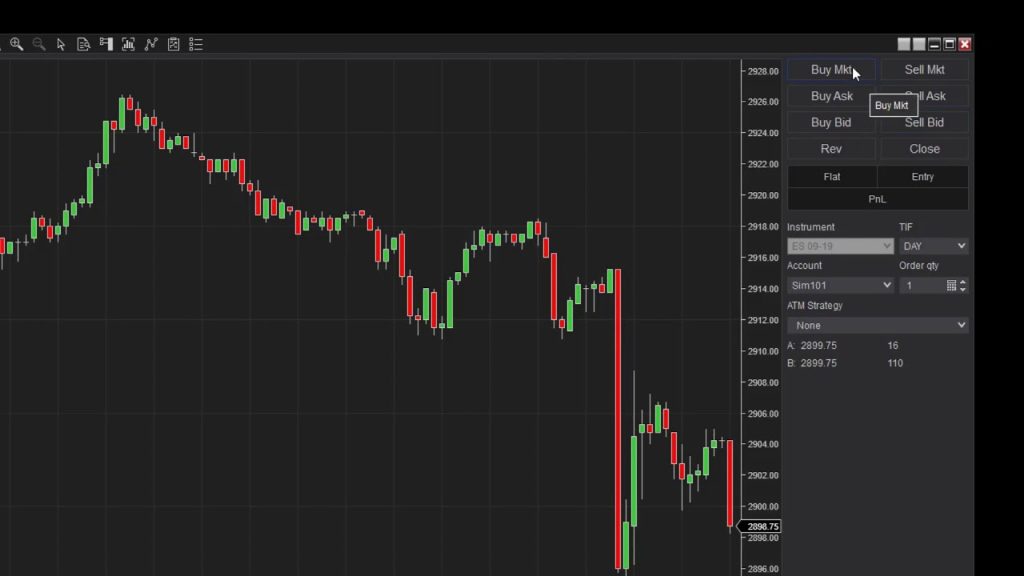

Trading platforms are some of the best crypto trading tools for streamlining your trading to the next level. Instead of having multiple windows open to trade across various exchanges, you can now trade on numerous exchanges from one platform! This can help you take advantage of market opportunities quicker and closely monitor the market better.

How to find the best crypto trading platform find below!

What are the Best Trading Platforms?

Coinigy

Coinigy is arguably the most widely used trading platform in the market. They began in 2014 and had been growing since. They support 45+ exchanges, trading charts, and quality support. 45+ exchange is more than any other platform, which gives a definite advantage to Coinigy users over non-Coinigy users.

They also have historical data that developers can use to experiment with their trading strategies. It’s one of the industry’s best crypto trading tools.

Tradedash

Tradedash supports both Bittrex and Binance, which are reliable, and amongst the largest exchanges in the market, so liquidity isn’t an issue. Unlike Coinigy, which is web-based, Tradedash is a desktop application. It means that users’ private keys are encrypted and stored on their machines for added privacy and security.

Charting Tools

How will a Charting Tool Help Me?

A charting tool is a tool that allows you to visualize different trading indicators and draw trend lines to visualize the market. Practice with these trading indicators and trend lines will ultimately grow your skills in technical analysis (TA), which many traders use to stay ahead of the curve. If you are a pro at TA, you can win big; for that, you need to use crypto analytics tools like those.

What are the Best Charting Tools?

TradingView

Tradingview is a large company offering live trading charts for crypto and stocks. They are one of the largest charting providers, with more technical indicators than you need. They have both free and premium functionalities. All the best traders use Tradingview as their primary cryptocurrency tool for charting.

Cryptowat.ch

Kraken, a central exchange, owns Cryptowat.ch. It is entirely free and allows you to chart across various coins and visualize 10+ charts in one view.

Market Data

It’s crucial to find platforms that offer near real-time, accurate information regarding price action, circulating supply, total supply, and more.

Why is Market Data Important?

Drawing in market data requires integrating with various exchanges, normalizing data, and calculating average prices, all while ensuring there are no errors. Having an accurate pulse on the market, with actual data, is a mandatory requisite for becoming a profitable investor or trader.

What are the Best Places for Market Data?

Coinmarketcap

Coinmarketcap is the most used site in the market for checking prices, volume, and supply of coins. They also have a robust API to pull data into your user interface, and it’s also helpful to know what everyone else in the market sees.

OnchainFX

OnchainFX offers data like Coinmarketcap but also provides more unique statistics. Users can see coins categorized as scams, top gainers, and top losers or view other figures which predict future market cap in the year 2050. You can also customize your dashboard! OnChainFX is slowly becoming one of the most trusted sources of market data. I highly recommend checking it out.

CryptoCompare

CryptoCompare is a site that has been around for a long time in the industry. They offer reliable market data, tools to track your portfolio, and informative articles to learn about new developments and different coins. With a following as large as theirs, it’s worth considering CryptoCompare.

- Never Miss a Hard Fork, Airdrop, Swap, or Block Halving

Rather than relying on news articles to gather your information, use a couple of trusted calendar services to look ahead. They will let you view upcoming events at a glance.

Why is this important?

When a coin halves (like Bitcoin in the first part of 2020), the price increases, or if a hard fork occurs, there is a chance to get free coins. The point is that these events can impact the price of coins or are ways to get free money. So you can take advantage, and it can turn into big bucks!

Which of these crypto analytics Tools is your Favorite?

A hands-on approach is the best approach for testing out different strategies and tools that work for you. Having heard of these crypto tools gives you a massive advantage over other investors. The next step is taking action and throwing yourself in the fire. Try the tools I suggested – most are free, and if they’re not, most have a trial period. Once you decide which tools suit you best, which order to use them in and ultimately create a routine, you will notice improvements in your investment strategies.

For more information https://www.cointree.com/learn/crypto-trading-tools/

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that AMPRaider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and AMPRaider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.