Decentralized Finance (DeFi) has become a game-changer for the current economic system, addressing many of the flaws in the existing financial systems. One of the captivating opportunities is opened by synthetic assets that have the potential to provide broader liquidity and access to different asset classes. This article will look at synthetic crypto assets and how to invest in them.

What Are Synthetic Assets?

Synthetic crypto assets are financial instruments in ERC-20 smart contracts known as “Synths,” which are comparable to derivatives in traditional finance.

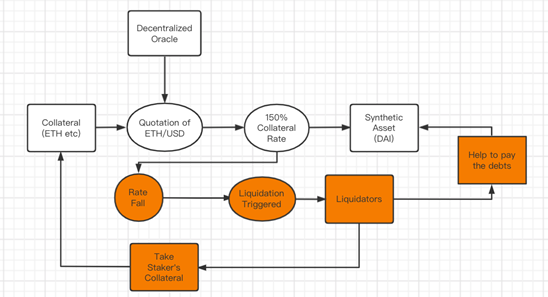

A derivative is a financial contract that derives its value from the underlying asset, index, or interest rate. These assets range from indexes, inverses, cryptocurrencies, and real-world assets like precious metals or fiat. Synths use a smart contract-based protocol to track the value of real-world assets and allow one to trade assets without actually owning them.

Synths are distinct from tokenized commodities, For example, the gold-backed PAX Gold (PAXG) token. Owning PAXG means that the company holds underlying gold on your behalf. Owning synths implies that you have exposure to the price of gold. However, you do not own the underlying asset.

Synths can be created for any asset. For example, one synth designed to mimic the value of the U.S. dollar is called sUSD. sBTC is another synth that replicates the price of a Bitcoin.

Synths expose a wide range of assets that are not always accessible to the average crypto investor, such as gold and silver. It allows holders of asset classes to interact with other assets they otherwise have no access to.

It implies that an owner of oil stakes could, for instance, trade their oil position for a Bitcoin position. Or a Bitcoin holder can exchange their asset for silver.

How Can I Trade Synthetic Assets?

Today, there are a few synthetic asset exchanges. The most established one is Synthetix. Synthetix is a decentralized and permissionless derivatives liquidity protocol built on the Ethereum blockchain.

Synthetix uses two cryptocurrencies to offer its synthetic asset minting service. The ecosystem is powered by the Synthetix native token, the Synthetix Network Token (SNX). The token can be staked to create synthetic assets. The second cryptocurrency is synths, which can mimic any investment.

A user must purchase SNX and deposit it on the Synthetix platform to produce synths. In exchange, Synthetix generates the user’s preferred new synth token.

SNX tokens back synths value. Say a user wanted to mint a synthetic U.S. dollar. If the user deposited $1,000 worth of SNX cryptocurrency, they would receive $133 worth of sUSD. According to software rules, the value of SNX locked would then need to remain at or above 750% of the value of the synth created.

SNX tokens are minted when a staker puts collateral down using a Mintr application dedicated to interacting with SNX contracts. Users who lock their SNX are rewarded SNX transaction fees for participating in the Synthetix network and continued over-collateralization of the synth token.

Since SNX is a cryptocurrency, the open market decides how much it is worth. As the price of SNX rises or falls, the number of synths in use may alter. For instance, if the cost of SNX increases, the system will release SNX tokens that are no longer required to ensure earlier synths.

Consider the case when the cost of SNX increased. It suggests that $500 of the $1,000 in SNX that was initially locked up could be released. The user could use that SNX to create $500 more in sUSD synths. It means that the higher the price of SNX, the more synths can be created.

Here is the process to follow if you want to stake and trade synthetic assets.

- Obtain SNX tokens on an exchange or exchange other cryptocurrencies with them.

- To create a synthetic asset, the user must deposit collateral (for example, SNX for Synthetix). The collateral will back the minted synthetic asset with real value.

- Oracles track the target asset’s price in real-time.

- Users can use the Synthetix platform to trade assets like sBTC, sUSD, or other equities.

- Minters retain a reward for minting and creating liquidity for exchange-traded assets paid in the protocol’s native asset.

Synthetic Assets Vs. Traditional Derivatives

Synthetic assets and conventional derivatives vary primarily in tokenizing the relationship between an underlying asset and the derivative product rather than using contracts to establish the chain.

A tokenized derivative that imitates the value of another asset is a synthetic asset. Therefore, synthetic assets can expose every asset in the world from within the crypto ecosystem.

Traditional derivatives were revolutionary in unlocking additional value from assets like equities. Synthetic assets open up countless pools of global liquidity by allowing anything to be tokenized and added to the blockchain.

Synths are unique because it is a “stock” represented in the form of tokens, and the value of that stock is determined by an oracle’s judgment of an index.

There are multiple advantages that synthetic assets have over traditional derivatives.

- Allows moving freely between equities, gold or silver-based derivatives, and other assets without holding the underlying asset.

- Synthetic assets can be sent and received using standard cryptocurrency wallets.

- Synthetics can be traded on every cryptocurrency exchange in the world.

- Blockchain-based synthetic assets can be minted by anyone using open-source protocols like Synthetix.

Synthetic assets offer the potential for seemingly limitless markets and combinations for new sources of value outside of straightforward derivatives trading. Unlike traditional derivatives, synthetic assets provide more liquidity across international exchanges, swap protocols, and wallets. Using this technology, any asset imaginable could be brought onto the blockchain.

However, there are some drawbacks of synthetic assets to consider as well. One is that the learning curve associated with staking synths is higher than other DeFi projects and may discourage some users.

Additionally, synth staking demands over-collateralization of 750%, prohibitively expensive for most users and significantly more expensive than other DeFi initiatives.

Source

https://dailycoin.com/what-are-synthetic-crypto-assets-and-why-should-you-invest-in-them

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that ampraider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and ampraider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.