What is a supercycle?

A supercycle is a sustained crypto market bullish run. It involves crypto increasing in value over an extended period, gaining mass adoption similar to the internet and internet stocks after the dot com bubble.

It works more like positive feedback. This is where an asset comes, and people suddenly become interested in it. With this interest, the value rises, and as the value increases, more people begin to notice and invest. The more new people invest, the higher the value increases, and the cycle continues.

In the typical world, the supercycle is a rise in value sustained for several years over a decade. However, crypto is only part of your regular investment. It is a new asset that has broken various traditional asset features. It is also such a highly volatile industry with massive value changes.

Therefore, the supercycle in crypto is all about coins having a sustained market rise and hitting mass adoption in the long run.

What’s going on in the crypto market?

The crypto market has had a changing landscape throughout its existence. In the earlier days, most people didn’t consider crypto as the investment vehicle it is today. Many people believed they were a mere fad that would disappear after some time. Only the tech-savvy believed in the power of crypto and would mine it as a pastime from their personal computers.

However, the crypto boom of 2017 happened, and the crypto world exploded. With various crypto projects hitting billion-dollar market caps, the world was suddenly taking note of the new crypto possibilities. However, this would only run until early 2018, when the bubble burst, and the market corrected.

The Coronavirus pandemic happened. Even though crypto would gain and decline, the market never seemed to click like it did in 2017. The market was down such that Bitcoin was trading at around $4000 by March 2020.

While crypto seemed to struggle in the earlier coronavirus days, it had a resurgence and started gaining market value. It rose so fast that Bitcoin was hitting around $40,000 by the end of the year and hitting $64,000 by mid-2021. With this massive gain, Bitcoin had established itself as an ideal investment and a hedge against inflation. What was once meant to act as a medium of exchange was now also an investment option.

The changes have led to the current crypto market state, where various governments have accepted it as both a medium of exchange and a store of value. Countries like Australia, the UK, and the US recognize cryptocurrencies as assets and provide clear regulations for crypto traders. They charge capital gain taxes on crypto trades. Countries like El Salvador have since recognized Bitcoin as a national currency.

Following government crypto regulations, cryptocurrencies have since become more accessible. Crypto exchanges like Coinbase and Coinspot operate like traditional stock exchanges to provide a reliable platform for crypto trading. The exchanges also operate on Know-Your-Customer (KYC) protocols for better security and to avoid illicit transactions. Investors can develop various trading strategies using DCA and other trading techniques to make the most of their investments.

The traditional business world has also been attracted to crypto. Various merchants have since accepted Bitcoin, Ethereum, and other cryptocurrencies as payment methods for online and physical transactions. Even though it took time before happening, institutional investors have also accepted crypto as a viable investment option.

The influence of crypto has surpassed its use as currencies only. It is also looking to impact various other industries. For example, decentralized finances (DeFi) are looking to make it easier to access financial services without the limitations of traditional financial institutions. Non-fungible tokens (NFTs) are revolutionizing the media and entertainment industry as it allows for the digital holding of art, collectibles, and other assets.

The current crypto market is on an upward trend and looks to stay active.

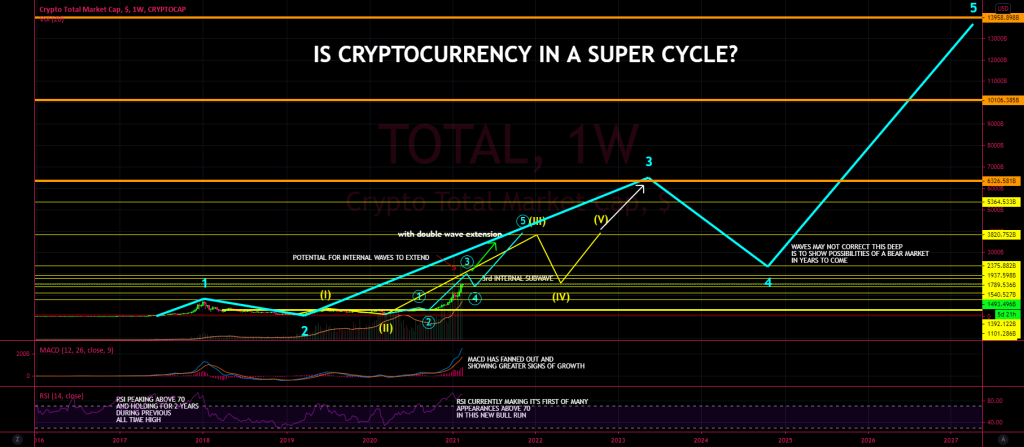

Is the crypto market currently in a supercycle?

Even though crypto has been around for relatively few years, the crypto market has already established a market cycle that is easy to follow. The crypto price movement relies on Bitcoin, as the other tokens mirror its movements. On the other hand, Bitcoin depends on various network activities for its price movements. One of these impactful activities is the Bitcoin halving that occurs every four years.

Bitcoin has led to a clear market cycle divided into four phases;

1. Accumulation is the first step of any market cycle, where people start investing in the token. It happens after the halving following the market correction. It is the best time to buy the token as it comes at the lowest prices and promises the highest returns.

2. Continuation – at this point, the market starts to note the increasing token value, given that investors have been buying more of it. Several more people purchase the tokens to capitalize on the growing market value. It leads to an even further value increase.

3. Parabolic – this is where the market would have reached its maximum. At this point, most investors would start selling off part or all of their assets to make a profit. As more people sell assets, the supply increases more than demand leading to a value decline.

4. Correction – the market goes to some of the lowest values as it settles. By this point, those who had not exited their positions would be counting losses or hodling. Most of those who never exit positions are the longer-term holders who understand the value would regain even higher in the next cycle. However, there is always the need to discern whether the project can recover or if it’s going down for good.

The current crypto market is in its parabolic stage. The crypto market is ever-growing as new investors keep joining the crypto network. Still, there is no way to tell when it will reach the correction phase. While the market has had a little setback, like the China crypto crackdown, it has since rebounded. Many analysts believe crypto valuations will continue to increase throughout the year. If this is the case, the thesis that this cycle is a supercycle gains more credibility.

The main Bitcoin super cycles when BTC reached the highest values in its history:

1. Nov-Dec 2013 (~$1,163 peak)

2. Dec`2017 (~$19,666 peak)

3. Nov`2021 ($69k peak)

Let’s try to see basic patterns by studying the ‘history’ of Bitcoin and its chart:

Highs and Lows

Let’s see how long it took to reach the lows:

· from the high of 2013 to the next low – 413 days

· from the high of 2017 to the next low – 364 days

Taking this, we can assume that after the low in November 2021, the low should occur in Nov-Dec’22.

Now let’s see how fast BTC recovered after every fall:

· from the low of the 1st cycle to the high of the 2nd cycle – 1064 days

· from the low of the 2nd cycle to the high of the 3rd cycle – 1057 days

If we project these repeated values onto the current market and take the Nov ’21 high as the starting point, we’ll see that the next high will be approximately in Nov-Dec’25.

Halving cycles

BTC halving occurs once every four years: 2012, 2016, 2020, and 2024.

If we go back to our highs (2013, 2017, 2021), they generally occur approximately a year after the halving.

So, with a high probability, we expect BTC to fly up to the next price level after the next halving in 2024.

Another bottom, around $13k, is quite real. But before reaching its high, BTC will likely go even lower than it currently stands. Also, each high BTC falls by about 80%. It adds to the theory that the current cycle bottom is in the $11k-$13k range.

Source

https://coinculture.com/au/markets/is-crypto-in-a-supercycle/

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that ampraider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and ampraider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.