Proof-of-stake still doesn’t fix all the other problems with Ethereum or cryptocurrency.

After eight years of promises that Ethereum would get off the blithering idiocy of proof-of-work cryptocurrency mining, the merge of the ETH blockchain into the new Beacon Chain system, formerly ETH2, is scheduled for some time between 15 and 20 September 2022.

If it happens this time, then hooray! Proof-of-work mining is a crime against humanity. Using a country’s worth of electricity and thus pumping vast amounts of carbon dioxide into the air is unconscionable.

But that won’t suddenly make cryptocurrency good. Proof-of-stake still doesn’t fix all the other problems with Ethereum or cryptocurrency.

Decentralization is always fake. Proof-of-stake pretends to change that — and it doesn’t.

And that’s before we get to the community angst over whether US jurisdiction validators will follow OFAC sanctions because they have to.

Proof-of-stake will still be a vast improvement over proof-of-work. And will cause much-needed political problems for bitcoin’s proof-of-work.

In all other senses, none of this matters.

Proof-of-work

Proof-of-work (POW) cryptocurrency mining was invented for bitcoin. Satoshi Nakamoto needed a way to add transactions to a ledger, ensuring nobody spent a coin twice — but without any central authority. And he also wanted to distribute fresh bitcoins. So he paid the transaction processors with a bitcoin reward.

If you give coins to anyone who asks, you don’t know if it’s a thousand people asking or one person with a thousand sockpuppets. So Satoshi required an unforgeable commitment for everyone who wanted the bitcoin reward: competitive waste of resources.

You throw away computing power as fast as possible to show you deserve the bitcoins. Your chance of winning the bitcoin lottery is directly proportional to how much you waste.

Bitcoin mining now uses over 0.5% of all the electricity in the world — for the duplicate seven transactions per second it managed to do in 2009. Bitcoin is the most inefficient payment system in human history.

Ethereum copied bitcoin’s stupid system because they didn’t have anything better that they could claim was decentralized.

Proof-of-stake

Proof-of-stake (POS) was first proposed by BitcoinTalk user QuantumMechanic on 11 July 2011. You show your commitment by holding coins. Your chance to validate the next block and get the coins is proportional to your current holding: [BitcoinTalk]

I wonder if, as bitcoins become more widely distributed, a transition from a proof of work-based system to a plan explanation stake one might happen. What I mean by proof of stake is that instead of your “vote” on the accepted transaction history being weighted by the share of computing resources you bring to the network, it’s weighted by the number of bitcoins you can prove you’re using your private keys.

POS is a bit too obviously “thems what has, gets,” — so you must convince the users to go along with it.

There was zero chance that bitcoin would adopt POS. But many minor altcoins seized upon POS just because they needed something to let them pretend to be decentralized that wasn’t POW, and this was something. Most remained functionally centralized in practice.

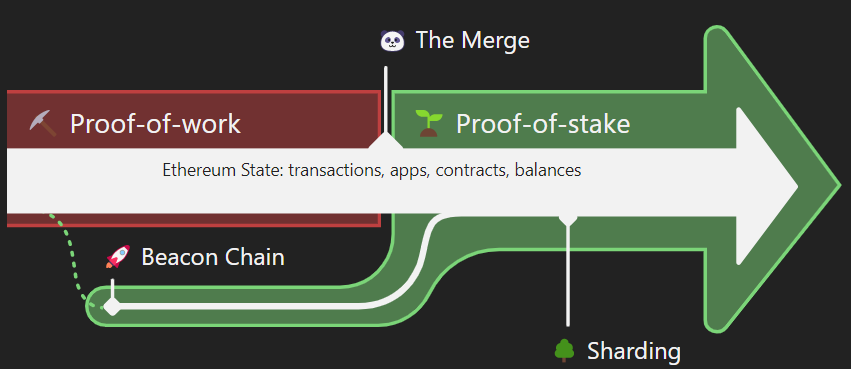

Merging to the Beacon Chain

There are many ways to do a proof-of-stake system. Ethereum’s new mechanism is the Beacon Chain.

A participant validates a block of transactions. Other validators then confirm and attest that the block is valid. Once there are enough attestations, the new block becomes part of the Ethereum blockchain, and participants get a block reward of some ether. If a validator goes offline or attests to invalid transactions, it can lose its stake (“slashing”). [Ethereum.org]

To run a validator, you have to stake 32 ETH. Staked ether cannot be withdrawn yet — that’s coming in a future version of Ethereum. For now, if you stake ether, it’s unavailable to you, and you just block rewards back from your stake.

There are a fixed number of blocks to go on Ethereum, with the last being expected around 15 September. The Beacon Chain validators will then continue the Ethereum blockchain. [Twitter; bordel.wtf]

But none of the technical details matter — because all of this is handwaving to pretend that a system full of central points of control is “decentralized.”

Decentralization was always fake.

The word “decentralized” is an attempt to abrogate legal blame for what happens on your network by claiming that your network doesn’t have any central control points.

Proof-of-work has efficiencies of scale — so it naturally recentralizes. By 2014, one miner had 51% of all bitcoin mining — when 51% had previously been the apocalypse scenario for bitcoin. By 2015, 80% of bitcoin miners were in the same stage.

Decentralization has been fake ever since. “Decentralised” is a legal claim of untouchability — and not an operational reality.

Ethereum copied bitcoin’s stupid system, and right now, it uses as much electricity as a slightly smaller country. Ethereum has even fewer mining pools than bitcoin.

Proof-of-stake is a glaring case of “we need something, this is something, we’ll seize on this.” (Compare bitcoin seizing upon the Lightning Network.) The critical point is to keep pretending that the system is meaningfully decentralized.

Staking is already as centralized as mining. The Lido staking pool, Coinbase exchange, and Kraken exchange add up to over 54% of the total stake. Them what has gets. [Etherscan]

The realactualtral control point in Ethereum is Infura — an interface to the Ethereum blockchain owned by ConsenSys. Infura has been Ethereum’s main point of control for many years. Almost 100% of helpful Ethereum transactions go through Infura because coding to Infura is vastly easier than coding directly to the blockchain. [CoinDesk, 2018] Ethereum’s decentralization is fake.

The Beacon Chain developers are not addressing the Infura problem whatsoever. They don’t seem to understand the question. They assume that if they can do everything via telnet to port 30303 by hand, everyone else must surely be just as capable.

Beacon Chain developer, Leonardo Bautista Gomez, said: “if Infura goes down today, the blockchain is still moving” — as if that addresses in any manner the issue of miners/validators, exchanges, and all the sites and DeFi apps that people are acting on Infura. It’s centralized in practice but hypothetically decentralized in the fabulous future! [Tech Monitor]

The final boss in Ethereum centralization is, of course, the Ethereum Foundation. The behavior of the blockchain is the behavior of the code.

What if the miners fork Ethereum?

Ethereum miners are being told to just bugger off. They could decide to fork Ethereum!

A fork of Ethereum was tried once before. In 2016, The DAO was hacked. The Ethereum Foundation and a majority of mining power decided to violate the immutability of the blockchain and wind back The DAO — because immutability lasts precisely and only until the big boys lose enough money.

One group started Ethereum Classic (ETC), which didn’t wind back The DAO. Nobody ever used ETC for anything; now it’s just another minor altcoin.

The winner for the title of official Ethereum will be the one the money backs. So far, the money is backing the Beacon Chain merge. Coinbase, the largest actual-dollar exchange, is assuming the merge is happening — in fact, Coinbase Prime is offering staking as a service. Circle, which issues the USDC stablecoin, has ardently supported the merge. So has stablecoin issuer Tether. So the official Ethereum Foundation Beacon Chain is going to win. [Coinbase; Circle; Tether]

Many people in crypto expect the spurned miners to try to fork Ethereum. I expect nobody to care any more than they did about Ethereum Classic. [Fortune]

Is Ethereum staking security?

The staking model for Ethereum is probably an investment contract under the Howey test of whether something is a security under US law — and many people realized this years ago. [Grant Gulovsen, 2019]

Crypto people deal with this glaringly obvious issue by putting their fingers in their ears and going “LALALALA,” so it’s back in the news now that the merge looks imminent. [CoinDesk]

Ethereum staking involves:

- “an investment of money” — your 32 ETH stake.

- “in a common enterprise” — Ethereum

- “with a reasonable expectation of profits” — the validator specification document says “verify and attest to the validity of blocks to seek financial returns” [GitHub]

- “derived from the efforts of others” — promotion and management of the scheme by the Ethereum Foundation and money from the retail suckers.

The SEC and the CFTC started looking into this question in 2019. [CoinDesk, 2019, archive]

Coinbase is offering staking as a service. The SEC won’t be a big problem here because they’re offering it only to institutional clients, so t staking as a service is pretty clearly a service. [Coinbase blog]

The question is whether the SEC can argue in a legally robust way that Ethereum validation is generally an investment contract — and that the ETH tokens involved are securities.

Sanctioned addresses on Ethereum

Ethereum mixer — i.e., money launderette — Tornado Cash was sanctioned by the US Treasury, via its Office of Foreign Assets Control (OFAC), on 8 August. This immediately entered discussions on the merge. Quite a chunk of staking is by entities who would likely be required to comply with US sanctions.

So what can a validator do? It’s easy not to process transactions that end in a Tornado Cash address. A validator could also refrain from attesting blocks containing sanctioned addresses — as even affirming a sanctioned transaction could count legally as providing services to a sanctioned entity.

Those transactions will never enter the blockchain if enough validators censor sanctioned addresses. 33% of validators acting together could block quite a lot of transactions. If 66% block particular addresses, those addresses are effectively blocbarredm Ethereum.

Brian Armstrong from Coinbase says he’d rather shut down Coinbase’s staking product than censor transactions. [Twitter]

Luke Youngblood originally built Coinbase’s staking product. He says that all Coinbase’s validators are outside the US. However, Coinbase is still a US company. Does Coinbase feel lucky? [CoinDesk]

That said, I think it’s unlikely that OFAC will take action against validators — unless there are North Korea levels of sanctions-breaking going on, and OFAC can’t find any other way to block it. OFAC did talk to Tornado Cash before bringing the hammer down.

US bitcoin miners don’t block transactions involving sanctioned entities — even though Marathon used to. OFAC hasn’t acted against the US bitcoin miners on this point.

But if OFAC tells US bitcoin miners or Ethereum validators that it wants those transactions blocked, they’ll have to do so.

If this happens, I don’t think OFAC-enforced transaction blocking will be met with a stirring rise of libertarian ideology. Approximately 100% of participants have a firm ideological commitment to being in it for the money.

Infura blocks for sanctions have already caused a lot of trouble for non-US Ethereum users. Nobody moved their stuff off Infura.

USDC is the dollar of choice in DeFi. Circle is already freezing sanctioned USDC — they’re a US entity, so they have to.

If sanctioning Tornado Cash is the price of being able to use USDC and cash out at Coinbase, that will override all other considerations.

Proof-of-stake doesn’t fix any other problem in cryptocurrency.

Proof-of-stake does not fix any of the other issues with cryptocurrency — because they’re implicit in the aims and design of cryptocurrency.

Transactions will still be irreversible — all errors, fat-finger fumbles, and hacks are final. The cryptocurrency world considers this a feature, not a significant failure of design from which every other problem follows.

The crypto world still runs on crank economics and crank politics. You can tell by the bleating about the issuance of new ETH as if this matters — there are more than enough large ether holders who could crash the market in a second if they were of a mind to. These people still consider they can code around all societal obligations while espousing a variant of Austrian bitcoin economics.

About 100% of participants in the Ethereum ecosystem are in it for the number go to. These are people who believe get-rich schemes are real.

The Ethereum blockchain will still be clogged to unusability, and the gas fee structure will remain the same.

Validators will continue to front-run users. This would normally be considered a massive systemic failure, but the Ethereum Foundation has endorsed “MEV” (miner-extractable value) as how things are. Remember: always declare your worst bugs are features. [arXiv, PDF; Ethereum.org]

NFTs won’t have their current ghastly energy footprint, so that’s nice. NFT bros will still be NFT bros, scamming artists and each other. All your apps will still be gone.

Good news for bitcoin

We still need Ethereum to go proof-of-stake as absolutely soon as possible — because, apart from saving a country’s worth of electricity, it’ll put massive political pressure on bitcoin’s waste of a country’s worth of electricity.

The European Union’s mooted ban on proof-of-work didn’t go through this year, but it’s likely to be reintroduced to the discussion: [Netpolitik, 2021, PDF]

If Ethereum can shift, we could legitimately request the same from BTC. We need to “protect” other crypto coins that are sustainable. Don’t see the need to “protect” the bitcoin community.

I’m surprised that bitcoin advocates haven’t been working harder against the Ethereum merge.

What does this mean for users?

End users should notice no difference whatsoever. Everything should keep working the same. Barring an unforeseen disaster, there shouldn’t even be any downtime.

Nothing will be any faster. Gas fees will work on the same model. Miners will still front-run users.

Ethereum is a platform for applications. As long as the smart contracts tick along, you can run your penny stock frauds, and you can cash out your ether winnings at Coinbase, all is well. Nobody will care about any further details.

Centralization doesn’t matter. The market never cared about the ideology of decentralization — they’re in it for the money. If anyone cared about decentralization, nobody would use Binance Smart Chain.

All the users want is a system that runs their EVM applications that they can cash out from easily. The Ethereum Foundation spent eight years trying to construct a mathematically robust proof-of-stake system, which never mattered. The ideology was only ever marketing.

The Ethereum Foundation still claims that Ethereum will be defiharding sometime in the fabulous future to process the blockchain in parallel — faster than the maximum throughput of a single node. Presumably, they’re betting that they can make sharding work without solving P=NP, which I strongly suspect was the problem they failed to work around when Casper proof-of-stake didn’t make it out of the door in 2018. Maybe they’ll finally all win Fields medals for successfully breaking mathematics.

But as long as DeFi can still rug pull, and Web3 can still incentivize securities fraud, the market won’t care about a few noisy weirdos tweeting ideology.

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that ampraider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and ampraider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.