Read This Controversial Article And Find Out More About the RISKS AND CHALLENGES FOR NFTS

What are NFTs?

To begin the article, it’s essential to understand what NFTS are and what role they play in the world of cryptocurrency.

NFT (Non-Fungible Tokens) is a digital certificate of authenticity. Currently, NFTs are digital tokens that involve digital arts, digital assets, music, video, and or any other asset in the digital world created on blockchain technology.

On auction, classic works of art, antiques, vinyl, first-edition books, and other historical items are sold. All items are certified to be authentic before being put up for auction.

NFTs are created with a similar concept. However, they exist in the digital world. NFTs can allow any video, MP3, image, GIF, or other file format and certify it as unique and original. Earlier, no technology was available for the ownership of digital assets, and an ownership claim of the digital asset was simplified by blockchain technology.

In this digital environment, people can collect, sell, buy, and or wreck NFTs. Blockchain technology keeps a transaction log and the price of that NFT, so it is visible to everyone on the internet.

NFT’s Environmental Impact

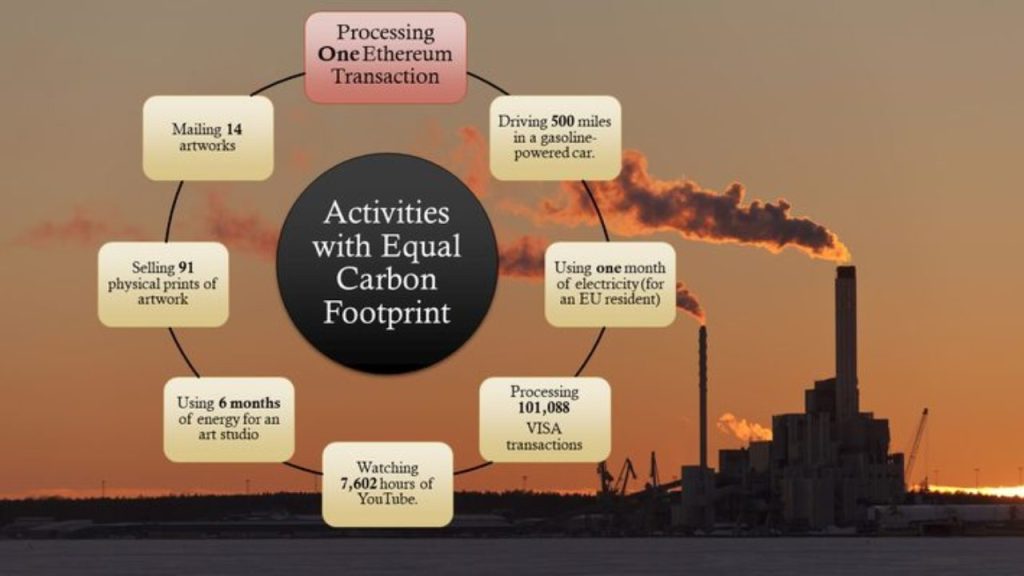

The role of NFTs in the future is uncertain, but the environmental impact of NFTs, mainly due to the energy used in mining to confirm the blockchain transaction, should be addressed.

The storage methods used to house NFTs based on blockchain technology emit millions of tons of carbon dioxide, which is harmful to an already overheated planet.

NFTs aren’t environmentally friendly. Most NFTs trade on the Ethereum network, meaning each transaction uses a mining process to confirm the trade and transaction. The energy used in mining concerns many who feel that it can add to carbon emissions if non-clean energy sources are used.

NFTs require energy to confirm each blockchain transaction, and this means that it uses an equal amount of energy when resold, multiplying the effect of any one NFT on the market.

How are NFTs and Digital Art Disastrous for the Environment?

By 2025, the digital world’s global carbon emissions will represent 9% of greenhouse gas. The environmental impact of NFTs is not likely to improve the situation.

The problem lies in their high energy consumption and, more precisely, the energy the blockchain uses that allows them to exist. This technology comprises blocks of binary information that record transactions and exchanges of signals on a network.

Bitcoin and Ethereum networks are the most renowned, and most digital art uses the Ethereum blockchain. Ethereum is one of the more energy-intensive forms of blockchain, and its impact on the environment is substantial. This situation is flexible, and blockchain companies are taking steps to reduce emissions.

Celebrities Promoting NFTs

Investigation into celebrities who promote non-fungible tokens (NFTs) on their social media channels discovered that it is permeated with deception, including a failure to clearly and prominently disclose the promoter’s material connection to the endorsed NFT company. In addition to revealing other material information, such as the risks associated with investing in such speculative digital assets, the financial damage resulting from such investments, and the personal benefit(s) the promoter may gain under the promotion(s).

Negatively Impact Carbon Footprint

The widespread popularity of digital art is starting to be outweighed by its carbon footprint, which is high. Despite the recent craze surrounding digital art, its negative environmental impact must be considered. Every aspect of online activity consumes energy, and digital art is no exception; the machines and servers that store blockchain hum away, consuming massive amounts of energy.

For example, the NFT GIF “Space Cat” (depicting a cat in a rocket soaring towards the moon) uses the same amount of energy an average European citizen uses for two months. The problem is that this example is only one in a million, as reported in an analysis by digital artist Memo Atken, who calculated that a single Ethereum transaction is estimated to have a carbon footprint on average of 35 kWH. It is equivalent to an EU resident’s four-day electric power consumption.

How it Works:

1. Most NFTs use the Ethereum blockchain, which requires a proof-of-work system that confirms each new block.

2. Computer networks solve complex problems to get the right to confirm the block.

3. The entire network uses energy in hopes of receiving the gas fees generated in the confirmation of the block.

4. This system incentivizes miners to invest in more hardware that requires even more power from the grid.

5. Power sources that emit greenhouse gases negatively impact the environment.

Challenges and Risks Associated with NFTs?

Non-Fungible tokens are making massive incomes for their creators. Artworks are sold online daily, and a creator can earn millions in seconds when their NFT is sold in this space. It can also be seen that people are purchasing, selling, and investing in the digital market with enthusiasm rather than trading in the physical market.

This gives considerable rise to the possibility of cyberattacks and online fraud. There are high chances of damage to digital assets and investors buying and selling NFTs. NFTs have enormous potential. However, there are certain risks that one needs to consider.

If you are considering getting into the NFT market, understanding these risks and challenges with NFTs is essential.

NFTs Smart Contract Risks

The risk of smart contracts and maintenance of NFT is a critical one currently prevailing in the market. Cyber hackers attack a DeFi (Decentralized Finance) network in several scenarios and steal crypto.

Recently, hackers attacked the most-renowned DeFi protocol named Poly Network, and $600 million were stolen in this NFT theft. The reason behind that theft was that security was inadequate.

The hackers exploited the defects of smart contracts to attack the Poly Network. The Poly network is beneficial for swapping tokens on different blockchain networks, and it tells us you can only expect complete security if smart contracts have a minor defect.

Evaluation Challenges

A significant challenge in the NFT market is the determination of the price of the NFT. The cost of any NFT will depend on creativity, uniqueness, and scarcity. Fluctuations in the prices of NFT are considerable due to a nonfixed standard for any specific kind of NFT.

People cannot determine the factors that might drive the price of NFT. Therefore, price fluctuations stay constant, and evaluating NFT remains a significant challenge.

Legal Challenges

NFT has no known legal definition. Countries like the UK, Japan, and the EU, are in strategic discussion with different approaches for classifying NFT. Developing a body for setting regulations and legalizing Non-fungible tokens internationally is necessary.

A considerable rise in the NFT market is why having a regulatory body is essential. The use cases of NFTs show a vast incremental difference. Demands for a regulatory body due to this to enable adaptation to the rules and regulations of NFTs.

The current laws related to NFT still need to find its correct definition. As the market and variety of NFTs develop, the challenge to find solid ground for compliance is genuine.

Cyber Threats and Risks of Fraud Online

As the popularity of NFT grows, the chances of cyber threats to the NFT market grow. Numerous cases show replicas of the original NFT stores on the internet.

Due to the original logo and content, these stores look authentic. However, these counterfeit NFT stores are an enormous risk because they could sell NFTs not represented digitally. Furthermore, there are chances of counterfeit NFTs being sold in a fake NFT store.

A further risk is when someone impersonates a famous NFT artist and sells fake NFTs. Online fraud risks are substantial due to copyright theft, fake airdrops, fake NFT giveaways, and the duplication of NFTs. Some promote such giveaways on social media to gain more attraction. While promoting NFT, some people are scammed at such fake stores.

Intellectual Property Rights

The ownership of any NFT is another crucial topic under consideration. When purchasing an NFT from the market, find out whether the seller owns that NFT. There have been particular occasions where people pose as sellers are simply selling replicas. Here, the right to use that NFT is offered, but not the intellectual property rights is implied.

Discovery of the terms and conditions for the ownership of the NFT in the smart contract metadata is noted. There should be a rule that only the artists can display their NFTs. It is impossible to relate NFT marketplaces with customary property laws. New intellectual property rights must be considered, similar to the right to publicity, trademarks, copyrights, and the ethical rights for decentralized blockchain technology.

The Challenge of NFTs as Securities

Buying NFTs as securities is a consideration for some people. The SEC (Securities and Exchange Commission) stated that most NFTs in the market are being sold as securities. However, the Supreme Court has only associated NFTs with investment contracts. It can be seen as a massive risk for NFT. And NFTs need to pass specific parameters of the Howey test to be eligible to be seen as security.

The Future Environmental Impact of NFTs and Digital Art

This shift from PoW to PoS has been lauded by the cryptocurrency community and those working in the digital art world. However, the crypto-art industry still faces significant challenges in terms of environmental preservation. As the digital world is relatively new, a central concern surrounding its ecological impact must be considered, and rules and regulations must be created to curb its harmful effects.

Over two hundred fifty companies and individuals spanning the crypto and finance technology sector, NGO, and energy and climate sectors have joined the Crypto Climate Accord, inspired by the Paris Climate Agreement. The CCA is an initiative for the crypto community focused on decarbonizing the cryptocurrency and blockchain industry. This initiative set lofty goals: transitioning all blockchains to renewable energy by 2030, with a net carbon footprint reduced to zero by 2040. These goals are praise-worthy, but only the future will tell if they can meet them.

Comprehension of all the risks and challenges of NFTs before investing in non-fungible tokens is essential. Removing the dangers associated with NFTs will make it less complicated to buy and sell them.

An overview of the risks and challenges and their effects on NFTs can help create possible solutions. It is vital to have a unified regulatory framework, focused standards, and secure platforms for creating and trading NFTs. However, NFTs and cryptos, in general, continue to be a far more economical system than our present centralized methods, despite the risk and challenges.

Conclusion

NFTs shouldn’t be treated as a quick way to make money. Blockchain in financial services can add much value to the systems in place. However, investors should know how much money they can make on NFTs, or they are likely to lose it all in minutes.

NFTs allow investors to buy and sell digital assets like trading authentic, unique artwork. However, one must avoid jumping on the bandwagon, which can put them under financial stress. Thus, acquiring knowledge about NFTs, buying and selling, and other related information can help with informed decisions once an individual is in the NFT marketplace to trade.

NFTs are budding technology, and the craze around buying, holding, and selling NFTs has just mushroomed. It is still being determined where the future will take us, given the illiquidity, volatility, and highly fast-paced world of NFTs, along with its many risks for investors, buyers, and sellers alike. It is a technology that enables using blockchain in financial services for various applications, just like cryptocurrencies, so we will likely see several upgrades to counter the risks mentioned above.

It is vital to perform thorough research regarding non-fungible tokens. It is better to first understand all the risks and challenges. It will even make buying and selling NFTs in the market easier and more profitable by eliminating the risks.

Source

https://geekflare.com/nfts-challenges-and-risks/

Disclaimer

Although the material contained in this website was prepared based on information from public and private sources that AMPRaider.com believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and AMPRaider.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.